How to Correct Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) or Employer of Household Worker(s) Quarterly Report of Wages and Withholdings (DE 3BHW)

Annual Household employers are required to file the Employer of Household Worker(s) Quarterly Report of Wages and Withholdings (DE 3BHW) (wage report) on a quarterly basis and the Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) (tax return) with the amount due annually. These forms can be corrected by submitting adjustments through e-Services for Business, even if the original tax return or wage report was filed via another filing method.

All employers are required to electronically submit employment tax returns, wage reports, and payroll tax deposits to the Employment Development Department. You can use e-Services for Business to comply with the e-file and e-pay mandate. For more information and approved electronic filing and payment methods, visit E-file and E-pay Mandate for Employers.

Please refer to the Household Employer’s Guide (DE 8829) (PDF) for additional filing and payment requirements for Annual Household Employers.

Refer to the following e-Services for Business resources for guidance on how to enroll, file, pay and submit adjustments on e-Services for Business:

Adjustments on e-Services for Business

If filing an adjustment to a previously filed tax return (DE 3HW) or wage report (DE 3BHW) through e-Services for Business, refer to the type of adjustment below to determine actions needed.

Adjust the Tax Return

- Access the tax return you need to correct and enter the correct amounts for the year.

After you submit your adjustment:

- If there is an overpayment on your account, the EDD will initiate the refund process.

- If taxes are due, select Make a Payment from the confirmation screen to pay the additional tax amount plus penalty and interest. The penalty amount is 15% of the portion of the payment that is late.

Adjust the Wage Report

- Access the wage report you need to correct and enter the correct amounts for the quarter.

- Clear any previously filed wage lines from the Wage Information section and include only the wage lines for the affected employee(s).

- Include the grand totals for all employees in the Amended Grand Totals.

Adjust the Wage Report

- Access the wage report you need to correct and enter the correct amounts for the quarter.

- Clear any previously filed wage lines from the Wage Information section and include only the wage lines for the employee(s) being added.

- Include the grand totals for all employees in the Amended Grand Totals.

Proceed to the tax return adjustment, if tax return for the year has been filed and needs correction.

Adjust the Tax Return

- Access the tax return you need to correct and enter the correct amounts for the year.

After you submit your adjustment:

- If there is an overpayment on your account, the EDD will initiate the refund process.

- If taxes are due, select Make a Payment from the confirmation screen to pay the additional tax amount plus penalty and interest. The penalty amount is 15% of the portion of the payment that is late.

Adjust the Wage Report

- Access the wage report you need to correct and enter the correct amounts for the quarter.

- Clear any previously filed wage lines from the Wage Information section and include only the wage lines for the affected employee(s) by making the following entries:

- Enter the employee's Social Security Number (SSN), First Name, Middle Initial, and Last Name.

- Enter zero (0.00) for Total Subject Wages, PIT wages, and PIT withheld.

- Select the Wage Plan Code previously reported.

- Include the grand totals for all employees in the Amended Grand Totals

Proceed to the tax return adjustment, if tax return for the Year has been filed and needs correction.

Adjust the Tax Return

- Access the tax return you need to correct and enter the correct amounts for the year.

After you submit your adjustment:

- If there is an overpayment on your account, the EDD will initiate the refund process.

- If taxes are due, select Make a Payment from the confirmation screen to pay the additional tax amount plus penalty and interest. The penalty amount is 15% of the portion of the payment that is late.

Adjust the Wage Report

- Access the wage report you need to correct and enter the correct amounts for the quarter.

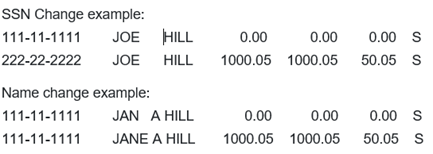

- Clear any previously filed wage lines from the Wage Information section and include only the wage lines for the affected employee(s). Correcting an employee’s SSN or name requires two entries for each employee, as follows:

First Entry:

-

- Enter the SSN and employee's First Name, Middle Initial, and Last Name as originally reported.

- Enter zero (0.00) for Total Subject Wages, PIT Wages, and PIT Withheld.

- Select the previously reported Wage Plan Code.

Second Entry:

-

- Enter the correct SSN, First Name, Middle Initial, and Last Name.

- Enter the Total Subject Wages, PIT Wages, PIT Withheld.

- Select the Wage Plan Code.

-

- Include the grand totals for all employees in the Amended Grand Totals.

Adjust the Wage Report

- Access the wage report you need to correct and enter the correct amounts for the quarter.

- Clear any previously filed wage lines from the Wage Information section and include only the wage lines for the affected employee(s). Adding an SSN for an employee previously reported without an SSN requires two entries for each employee, as follows:

First Entry:

-

- Enter all zeros (000-00-0000) for the SSN and the employee's First Name, Middle initial, and Last Name.

- Enter zero (0.00) for Total Subject Wages, PIT Wages, and PIT Withheld.

- Select the previously reported Wage Plan Code.

Second Entry:

-

- Enter the employee’s SSN, First Name, Middle Initial, and Last Name.

- Enter the Total Subject Wages, PIT Wages, and PIT Withheld.

-

- Include the grand totals for all employees in the Amended Grand Totals.

Refer to the Information Sheet: Reporting Wage Plan Codes on Quarterly Wage Reports and Adjustments (DE 231WPC) (PDF) for information on Wage Plan codes and which Wage Plan code corrections do not need to be reported.

Refer to How to Adjust a Previously Filed DE 3HW on e-Services for Business and/or How to Adjust a Previously Filed DE 3BHW on e-Services for Business below for step-by-step instructions on how to complete the adjustments to the tax return and/or wage report.

Log in to e-Services for Business and select the appropriate Employment Tax account:

- Select Manage Periods and Returns.

- Select the filing period for the quarter in which the information was reported incorrectly.

- Select File or Adjust a Return or Wage Report.

- Select View or Adjust Return under the Action column next to Tax Return.

- Select Adjust Return.

- If needed, update your answer to the question, “Do you have payroll to report?” by selecting Yes or No.

- If you answered Yes, select Next then enter the correct information for the following fields:

- Total Subject Wages Paid this Year

- UI Wages

- SDI Wages

- SDI Tax Withheld

- Personal Income Tax Withheld

- Contributions and Withholdings Paid for the Year

- Select Next

- If you answered No, select Next.

- Enter the Reason for Adjustment, then select Next.

- If no credit (decrease) adjustments were requested to SDI and/or PIT, go to step 8.

- If you requested a credit (decrease) adjustment to SDI and/or PIT, review and answer the questions regarding SDI and PIT overpayments on the Additional Information screen then select Next.

- Complete the Declaration information, then select Submit.

- Select Ok to submit the request.

- Review the information on the Confirmation screen, then select OK.

- If an amount is due, select Make a Payment from the Confirmation screen.

- Select Make a Period Payment by Period or by Credit or Debit Card Payment to pay the additional tax amount plus penalty and interest. The penalty amount is 15% of the portion of the payment that is late.

Adjustments to tax returns can be saved and completed later by selecting Save Draft. To access a saved return or report go to the Action Center.

Contact the Taxpayer Assistance Center at 1-888-745-3886 for further assistance.

Log in to e-Services for Business and select the appropriate Employment Tax account:

- Select Manage Periods and Returns.

- Select the filing period for the quarter in which the information was reported incorrectly.

- Select File or Adjust a Return or Wage Report.

- Select View or Adjust Return under the Action column next to Wage Report.

- Select Adjust Return.

- If needed, update your answer to the question, “Do you have payroll to report” by selecting Yes or No.

- If you answered Yes, select Next then go to step 7.

- If you answered No but previously reported wages, select Clear All Fields, and check Confirm in the confirmation box, then select OK. Select Next then go to step 10.

- Select Yes or No to indicate if you would like to import a csv file. Refer to the csv instructions on e-Services for Business for information on how to create the csv file.

- If you answered Yes, select Upload CSV File to import your file. Select Next when file has been uploaded successfully and verify that the wage detail has been entered correctly. Select Next when all wage line entries have been verified.

- If you answered No, select Next and report only the wage lines being corrected in the wage detail table. Select Next when all wage line entries have been entered.

Refer to the csv instructions on e-Services for Business for information on how to create the csv file.

- Enter corrected Number of Employees for the 1st, 2nd, and 3rd month in the quarter, if applicable.

- Complete the Amended Wage Totals. Report the corrected grand totals for all employees, not just the amended employees.

- Enter the Reason for Adjustment, then select Next.

- Complete the Declaration, then select Submit.

- Select Ok to submit the request.

- Review the information on the Confirmation screen, then select Ok.

Adjustments to wage reports can be saved and completed later by selecting Save Draft. To access a saved return or report go to the Action Center.

Contact the Taxpayer Assistance Center at 1-888-745-3886 for further assistance.

Filing Adjustments on Paper Adjustment Forms

If filing an adjustment to a previously filed tax return (DE 3HW) or wage report (DE 3BHW) on paper, complete a Tax and Wage Adjustment Form (DE 678) (PDF). Refer to Correcting Previously Filed Reports and Returns page of the Household Employer’s Guide (DE 8829) (PDF) for the instructions for completing a paper DE 678. Refer to the Instructions for Completing the Tax and Wage Adjustment Form (DE 678-I) (PDF) for additional information.

Contact the Taxpayer Assistance Center at 1-888-745-3886 for further assistance.

e-Services for Business

Stay Up-to-Date

Contact Us

If you have questions, Contact Payroll Taxes. You can also contact the Taxpayer Assistance Center at 1-888-745-3886 or visit your local Employment Tax Office.