Customer Survey: Payroll Taxes

The Employment Development Department (EDD) offers a range of services to help employers manage their employer payroll tax account including:

- e-Services for Business, our online application, to electronically submit employment tax returns, wage reports, and payroll tax deposits to the EDD 24 hours a day, 7 days a week.

- Taxpayer Assistance Center, which provides payroll tax assistance to employers toll-free at 1-888-745-3886.

- Employment tax offices located throughout the state.

For more information on payroll tax reporting requirements, visit Payroll Taxes.

This survey asked respondents to report their level of satisfaction with EDD services for managing payroll tax accounts. Percentages are rounded to the nearest whole number.

Highlights

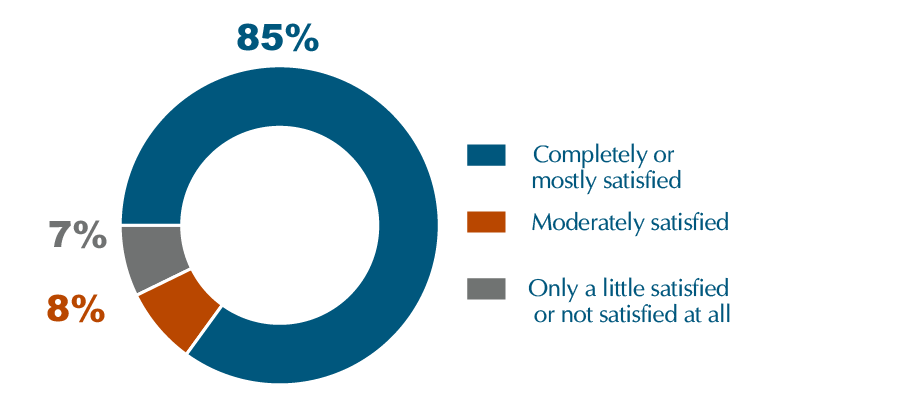

Respondent satisfaction with EDD services for managing their payroll tax accounts:

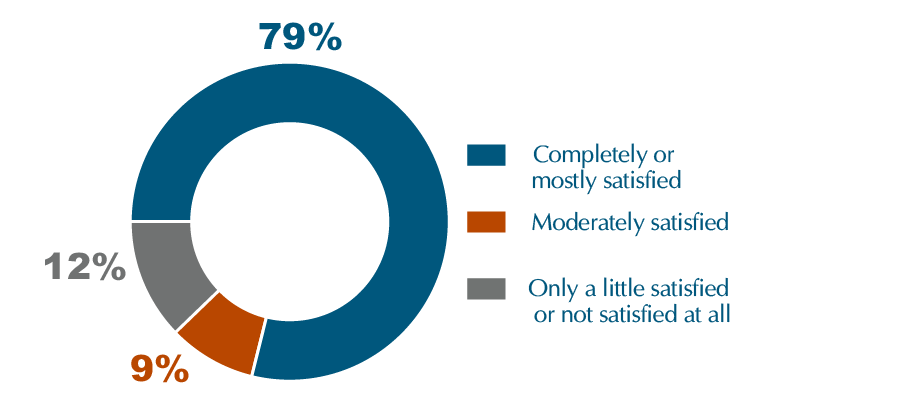

Respondent satisfaction with using e-Services for Business to make a payment:

Respondent satisfaction with using e-Services for Business to submit wage reports:

Survey Methodology

The EDD uses survey industry best practices to ensure our results represent our customers’ opinions. View the Tax Branch Customer Survey Methodology (PDF) for more information.